Strong capital position confirmed by ECB

November 14, 2015

Bank Degroof Petercam has successfully passed the Asset Quality Review (AQR) and stress tests as carried out by the European Central Bank (ECB). The results of ECB’s assessment were published on 14 November 2015 and confirm the quality of Bank Degroof Petercam’s assets and its capacity to withstand a scenario of major crisis in financial markets.

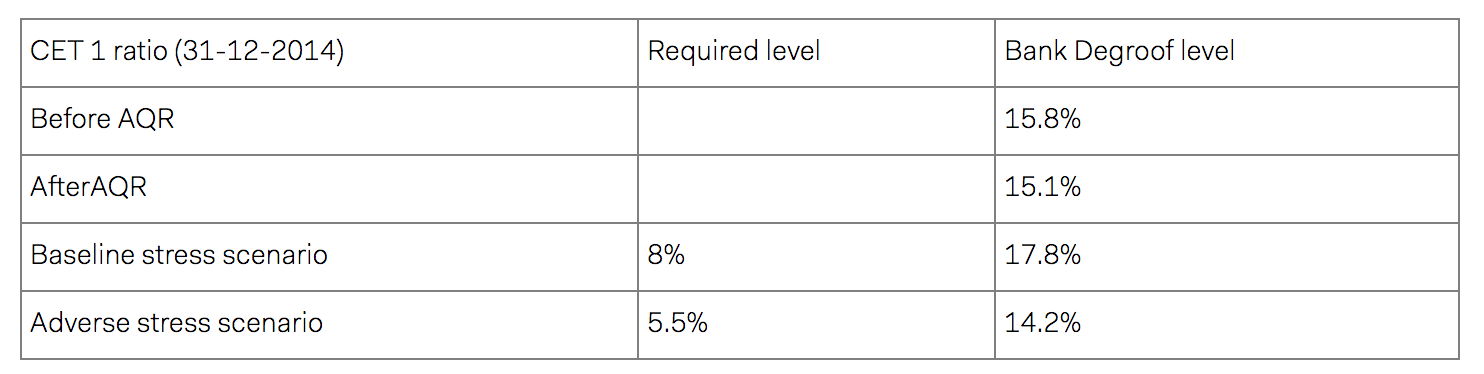

The ECB’s assessment consisted of an AQR based on Bank Degroof’s capital position as at 31 December 2014 and stress tests over a three-year horizon (2015-2017).

Bank Degroof Petercam significantly exceeds the capital benchmarks set out for the purpose of the stress tests. The effect of the AQR is minor: the Common Equity Tier-1 ratio (CET1 ratio) was adjusted from 15.8% to 15.1% due to the specific AQR methodology. The adverse scenario caused the CET1 ratio to fall from 15.1% as at 31 December 2014 to 14.2% in December 2017; a multiple of the ECB threshold of 5.5%.

Philippe Masset, CEO Bank Degroof Petercam: “We are pleased the assessment of the ECB confirms our prudent approach and stringent risk management. The balance sheet strength is not only demonstrated by the quality of our assets and accounting processes, but also by its resilience to extreme market conditions. Our clients can be confident that our commitment to serve their best interests encompasses our willingness to maintain a robust capital position.”

The ECB exercise was performed exclusively on Banque Degroof and did not assess the post-merger capital position of Bank Degroof Petercam. Considering the nature of Petercam’s activities which excluded significant credit activities, the results should remain valid for Bank Degroof Petercam.