Which countries are eligible for responsible investing?

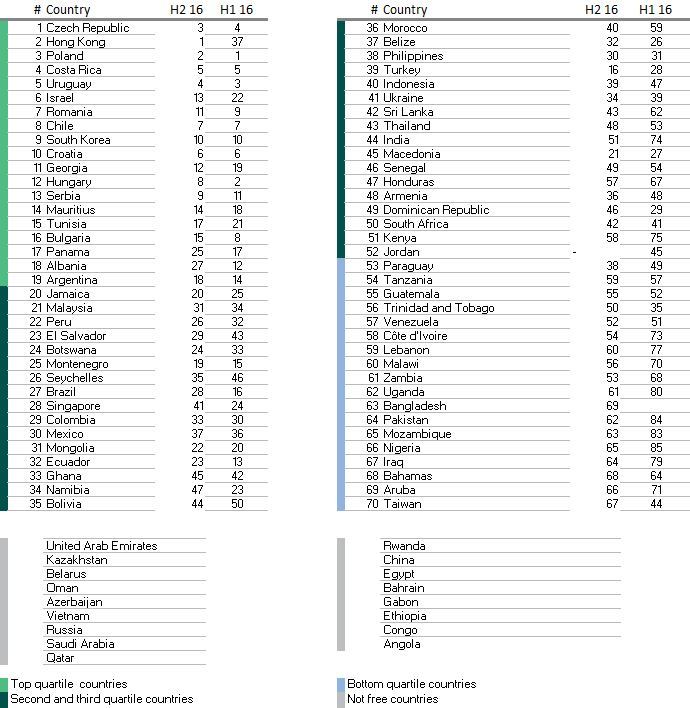

Sustainability ranking of emerging countries

June 1, 2017

- Degroof Petercam has developed an objective methodology to rank emerging countries and assess their appeal in terms of responsible investment.

- Main findings over the past year:

- Turkey has been relegated from the 13th to the 39th position and consequently drops out of the segment of most appealing sustainable countries. The country’s lack of freedom of the press and political instability are key aspects in that respect.

- Venezuela drops sharply in the ranking, to the 57th position and so the lowest segment, due in part to political

- Brazil loses a lot of ground.

By means of an objective and proprietary methodology, Degroof Petercam has since 2013 been developing an emerging market country ranking based on clear-cut criteria. “

“A country’s relative performance determines its appeal and the odds of it becoming eligible for investment in a sustainable investment fund. This allows an investment strategy to connect to the sustainable policy efforts a nation state makes”, says Ophélie Mortier, responsible investment strategist at Degroof Petercam.

Major trends

The latest sustainability analysis is set against a backdrop of increased political populism, which expresses widespread discontent regarding the political elites who have dominated campaigns for a long time. The latest report based on the Democracy Index published by The Economist Intelligence Unit and entitled “Revenge of the Deplorables” looks into whether democracy has triumphed, or whether it is under stress, in particular in the most developed democratic countries.

This crumbling confidence in governance institutions is a key element which needs to be closely monitored when it goes hand in hand with warning signals regarding other aspects of a country’s sustainability and stability.

Turkey and Venezuela tumble in the ranking

We highlight Turkey’s demotion in the ranking, and following the major deterioration of civil rights and liberties in the country it falls from the 13th to the 39th position. The democratic degradation in Turkey has been widely commented on by the media and NGOs. Turkey’s performance in terms of transparency and democratic values, which include other criteria complementary to civil liberties and political rights, has had a very strong impact on the country’s position in the ranking. As a matter of fact, on other factors such as education and population, wealth distribution and access to healthcare etc., the country is close to the performance of countries leading the pack, such as Poland and the Czech Republic. The underinvestment in renewable energy, and continued very strong dependence on coal, two factors contributing to very poor quality of air, also detract from the performance. Despite this appalling performance in terms of governance, Turkish sovereign debt in local currency remains a key component of market indices, weighing nearly 8%.

Venezuela is another telling example. The country, which is in the fourth quartile of the ranking, has seen its situation deteriorate further in the past year. Since April, there has been a growing number of opposition demonstrations against president Nicolas Maduro, and more than 25 people have been killed.

As its economy is almost perfectly correlated with crude oil prices, Venezuela’s debt can be compared to that of Russia, Colombia or Mexico. Please note that Russia has been excluded from the ranking from the outset as it does not respect minimal democratic values. Colombia and Mexico have significantly better ESG profiles, in particular thanks to their economic sustainability, which instils greater confidence, as well as a greater commitment to environmental issues.

Albania and Panama rise in quartile

Albania has entered the first quartile of the ranking. In terms of fixed-income markets, the country is often compared to the neighbouring countries of Montenegro and FYROM (Former Yugoslav Republic of Macedonia).

The country essentially distinguishes itself in terms of education* and the environment. The number of children enrolled in primary education is in particular higher than in Montenegro, and the number of drop-outs is lower than in Montenegro, which spends less on education.

In terms of the environment, the air quality is slightly better in Albania, and less coal is used. However, just like in neighbouring countries, renewable energy contributes very little to electricity generation. Against that backdrop, Albania ranks among the ten lowest ranking countries in the full universe.

Finally, Panama also climbs in the ranking, moving to the first quartile. Fixed-income markets attribute a fairly high rating to the country’s debt, which is primarily denominated in USD. Its debt is often compared to the USD-denominated debt of low-risk Latin American countries such as Chile and Mexico (with the Mexican peso being substantially more volatile). Chile is also in the first quartile, and has been for some time, and primarily stands out in terms of transparency and democratic values, as well as to a lesser extent in terms of healthcare, population and wealth distribution.

Methodology and returns

Degroof Petercam has been ranking emerging economies in terms of their sustainability profile since 2013. Drawing on its expertise involving OECD member countries since 2008, the methodology has been adapted to suit the intricacies of this universe, while nevertheless maintaining the five major sustainability pillars, namely (1) transparency and democratic values, (2) population, healthcare and wealth distribution, (3) environment, (4) education and innovation and (5) the economy.

“With the emerging country ranking having been around for three years, it was time to make an in-depth analysis of the added value a sustainability analysis of emerging economies can provide, something that many people believed was premature given the challenges they face. Thanks to the continuous monitoring of the model and its relevance, we are have indeed been able to achieve a good level of performance and to reduce risks. We continue to see that the contribution of the sustainability filter becomes even more important as volatility increases and markets head downwards. This demonstrates the value of the tool in better understanding risks,” says Ophélie Mortier.

* There is limited data on education for the FYROM (Macedonia), which weighs on the country’s score on this matter.